JustMarkets vs Exness – Best Broker for Forex & Indices (2025)

JustMarkets and Exness are recognized as top forex and indices trading brokers in 2025. Due to their competitive spreads in the current volatile markets, flexible account types, and solid execution, both platforms have earned great trust from international traders.

JustMarkets continues to draw traders with its competitive offers, flexible account types, and user-friendly platforms that cater to beginners as well as professionals, while Exness has established a solid reputation for its ultra-tight spreads, reliable execution, and global reach.

This article helps you choose the best broker in 2025 by comparing JustMarkets and Exness across key factors such as regulation, trading platforms, asset variety, fees, deposit and withdrawal methods, and customer support.

Editor’s Review: JustMarkets vs Exness — Who Is 2025’s Leading Broker?

Because of its extremely tight spreads, quick withdrawals, and extensive liquidity network that is trusted globally, Exness is still one of the most prominent brokers in 2025. On the other hand, traders looking for generous offers, easy registration, and flexible account options are drawn to JustMarkets. JustMarkets is the best option for beginners and intermediate traders seeking flexibility, lower entry points, and competitive promotions, while Exness is best for experienced traders who value execution speed and dependability.

Choose Your Broker and Start Trading Today

Pros & Cons: JustMarkets vs Exness

JustMarkets

- Flexible account types (Standard, Pro, Cent)

- Low minimum deposit starting at $1

- Attractive bonuses & promotions for new traders

- User-friendly onboarding and easy KYC process

- Offshore regulation (FSA Seychelles)

- Bonus withdrawals tied to trading conditions

Exness

- Ultra-tight spreads from 0.0 pips

- Instant deposits & withdrawals

- Trusted global broker with strong liquidity

- Wide range of instruments (forex, commodities, indices, crypto)

- High leverage not available in all regions

- Some advanced features better suited for pros

Regulations: JustMarkets vs Exness

JustMarkets Regulations

With licenses in multiple jurisdictions, JustMarkets combines reliable oversight with offshore flexibility. Clients gain from segregated funds, transparent operations, and protection against negative balances.

| Region | Regulator | Entity | License / Reg. Number |

|---|---|---|---|

| Seychelles | FSA | Just Global Markets Ltd. | SD088 |

| Cyprus | CySEC | JustMarkets Ltd. | 401/21 |

| South Africa | FSCA | Just Global Markets (PTY) Ltd. | FSP 51114 |

| Mauritius | FSC | Just Global Markets (MU) Ltd. | GB22200881 |

| British Virgin Islands | FSC (BVI) | Just Global Markets (VG) Ltd. | SIBA/L/24/1177 |

Exness Regulations

Among the brokers with the strictest regulations worldwide is Exness. It functions under several high-level and local regulators, guaranteeing openness, the security of client funds, and international compliance.

| Region | Regulator | Entity | License / Reg. Number |

|---|---|---|---|

| Seychelles | FSA | Exness (SC) Ltd | SD025 |

| Cyprus (EU) | CySEC | Exness (Cy) Ltd | 178/12 |

| United Kingdom | FCA | Exness (UK) Ltd | 730729 |

| South Africa | FSCA | Exness ZA (PTY) Ltd | 51024 |

| Curacao & Sint Maarten | CBCS | Exness B.V. | 0003LSI |

| British Virgin Islands | FSC (BVI) | Exness (VG) Ltd | SIBA/L/20/1133 |

| Mauritius | FSC (Mauritius) | Exness (MU) Ltd | GB20025294 |

| Kenya | CMA | Exness (KE) Ltd | 162 |

| Jordan | JSC | Exness Limited Jordan Ltd | 51905 |

Trading Platforms & Tools — JustMarkets vs Exness

JustMarkets platforms: Two of the most widely used platforms in the world, MT4 and MT5, are accessible to traders through JustMarkets and are accessible on desktop, mobile, and web platforms. These platforms offer a wide variety of indicators, automated strategies (Expert Advisors), one-click trading, and sophisticated charting. JustMarkets is made to accommodate the needs of traders of all experience levels globally with its variety of account types, low minimum deposits, and high leverage options.

Exness platforms: Exness offers extremely quick execution, raw spreads starting at 0.0 pips, and advanced trading tools for both MT4 and MT5. Traders can take advantage of automated strategies, copy trading, and institutional-grade liquidity with desktop and mobile access. Additionally, Exness offers negative balance protection, instant deposits and withdrawals, and a reliable infrastructure that is appropriate for both professional and retail traders.

Deposits, Withdrawals & Trading Fees

JustMarkets: accepts bank card, e-wallet, local transfer, and cryptocurrency deposits and withdrawals. Beginners can afford it because the minimum deposit is as low as $1. While withdrawal times vary depending on the payment channel, they are typically handled swiftly. The majority of deposit methods are fast. Although some account types have small commissions, trading costs are primarily spreads. Promotions and bonuses are offered, though they might need to be met in order to be withdrawn. There may be conversion or processor fees.

Exness: is well-known for instant deposits and withdrawals, including local banking systems, cards, e-wallets, and crypto. There are usually no broker fees for funding or withdrawals, though network/processor charges can apply. Exness offers raw spread accounts from 0.0 pips, with commissions on certain account types, plus overnight swap fees on leveraged positions. Minimum deposits vary depending on the account, but many start at $10. Reliability of fast payouts is a major draw for global traders.

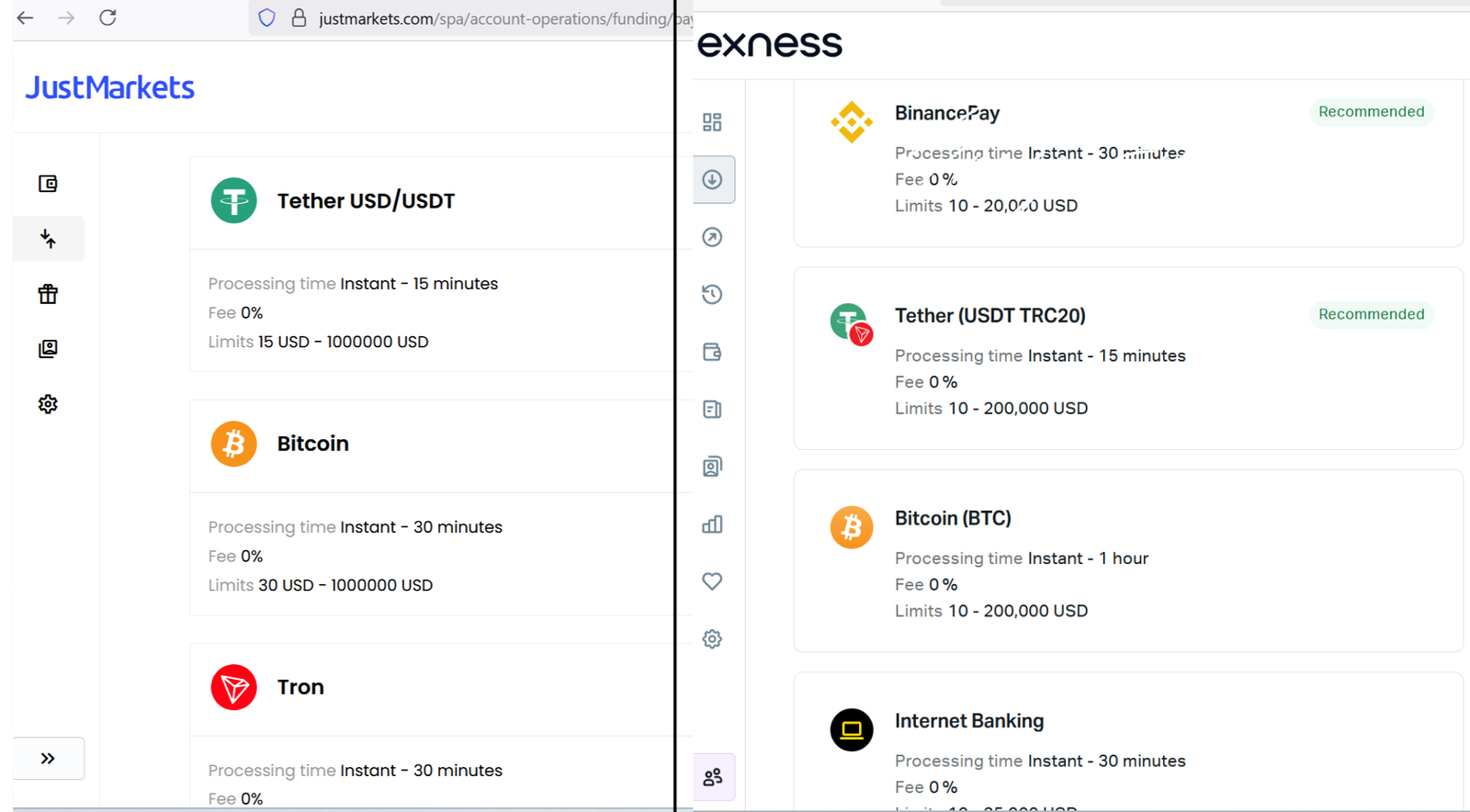

The suggested deposit and withdrawal methods for Exness and Just Markets are displayed in the image above. Instant deposits and withdrawals are available on both brokers’ suggested methods, which makes it easy for traders to effectively manage their money. Instead of waiting for transactions to clear, users can concentrate more on their strategies thanks to this instant processing, which improves the trading experience overall.

| Broker | Deposit Methods | Withdrawal Methods |

|---|---|---|

| JustMarkets | Cards E-wallets Local payments Bank transfer Crypto | E-wallets Bank transfer Crypto Cards* |

| Exness | Cards E-wallets Local banking Bank transfer Crypto | E-wallets Bank transfer Crypto Cards* |

*Availability depends on region, entity, and processor. Processing times are often instant, but may vary by method and verification.

Customer Support — JustMarkets vs Exness

JustMarkets support: offers email, live chat, and a full Help Center that covers platform usage, deposits, and account setup. Support is available 24/7, in multiple languages, and usually responds quickly. FAQs and informative articles on their website help new traders with funding, KYC, and MT4/MT5 setup.

Exness support: Offers 24/7 multilingual live chat, phone, and email assistance. Traders can access fast help with deposits, withdrawals, and technical platform issues. Exness also provides a rich knowledge base, status updates, and dedicated account managers for professional clients, ensuring reliable and prompt communication worldwide.

Account Types & Education

JustMarkets

Account Types: To accommodate all traders, from beginners to experts, JustMarkets provides a variety of account types. For low-risk micro-lot trading, you can begin with a Standard Cent account. The well-liked Standard account, available through MT4 and MT5, offers competitive spreads (starting at 0.3 pips) and no commissions. The Raw Spread account combines ultra-low spreads (from 0 pips) with per-lot commissions, while the Pro account offers tighter spreads and market execution for higher-quality trading. All account types also have access to Islamic (swap-free) versions. Additionally, demo accounts are available for risk-free practice.

Education Resources: Free educational articles, a comprehensive Forex glossary, instructional videos, daily market commentary, economic calendars, and currency information are just a few of the many learning resources that justMarkets provides to traders. These resources are intended to help beginners and expert traders equally gain confidence and become more astute traders.

Exness

Account Types: Exness caters to both new and advanced traders. Their Standard category includes both regular and Cent versions—great for micro-trading, no commissions, and spreads from 0.2–0.3 pips. For professional trading, Exness offers Pro accounts with zero commission and tight spreads from 0.1 pips, Raw Spread and Zero accounts offering near-zero spreads with a small per-lot commission. Islamic (swap-free) and demo accounts are also fully supported. :contentReference[oaicite:2]{index=2}

Education Resources: Exness provides a rich, free education hub including trading guides, articles, strategy breakdowns, video tutorials, and webinars covering fundamentals to advanced topics. Beginners and seasoned traders alike can use these materials—alongside demo accounts and economic tools—to enhance their trading proficiency.

Learn with Exness — Video Tutorial

JustMarkets Tutorial Video

Mini FAQ — JustMarkets vs Exness

Which broker is better for traders in 2025?

Exness is popular with professional traders thanks to its tight raw spreads, fast execution, and instant withdrawals. JustMarkets appeals to beginners and intermediates with its $1 minimum deposit, flexible account types, and frequent promotions.

What platforms do they support, and can I use a demo?

JustMarkets: MT4 & MT5 on desktop, web, and mobile — free demo accounts available. Exness: MT4 & MT5 with mobile/web access — free demo accounts and professional-grade tools are also available.

How do deposits, withdrawals, and fees compare?

JustMarkets: supports cards, e-wallets, bank transfer, local payment systems, and crypto; deposits start from $1. Costs are mainly spreads, with commissions on Raw Spread accounts. Exness: offers cards, local banking, e-wallets, and crypto with instant deposits/withdrawals. Fees are competitive with raw spreads from 0.0 pips on Pro accounts plus small commissions.

Conclusion — Our Pick for 2025

Both brokers offer significant benefits, but JustMarkets is a better option for beginners and budget-minded traders due to its $1 minimum deposit, variety of account types, and regular promotions. However, because of its extremely tight raw spreads, instant withdrawals, enormous liquidity, and extensive global regulatory presence, Exness leads the market overall. If you value professional-grade conditions and worldwide trust, choose Exness; if you want simplicity, bonuses, and easy onboarding, choose JustMarkets.